cash flow from assets formula

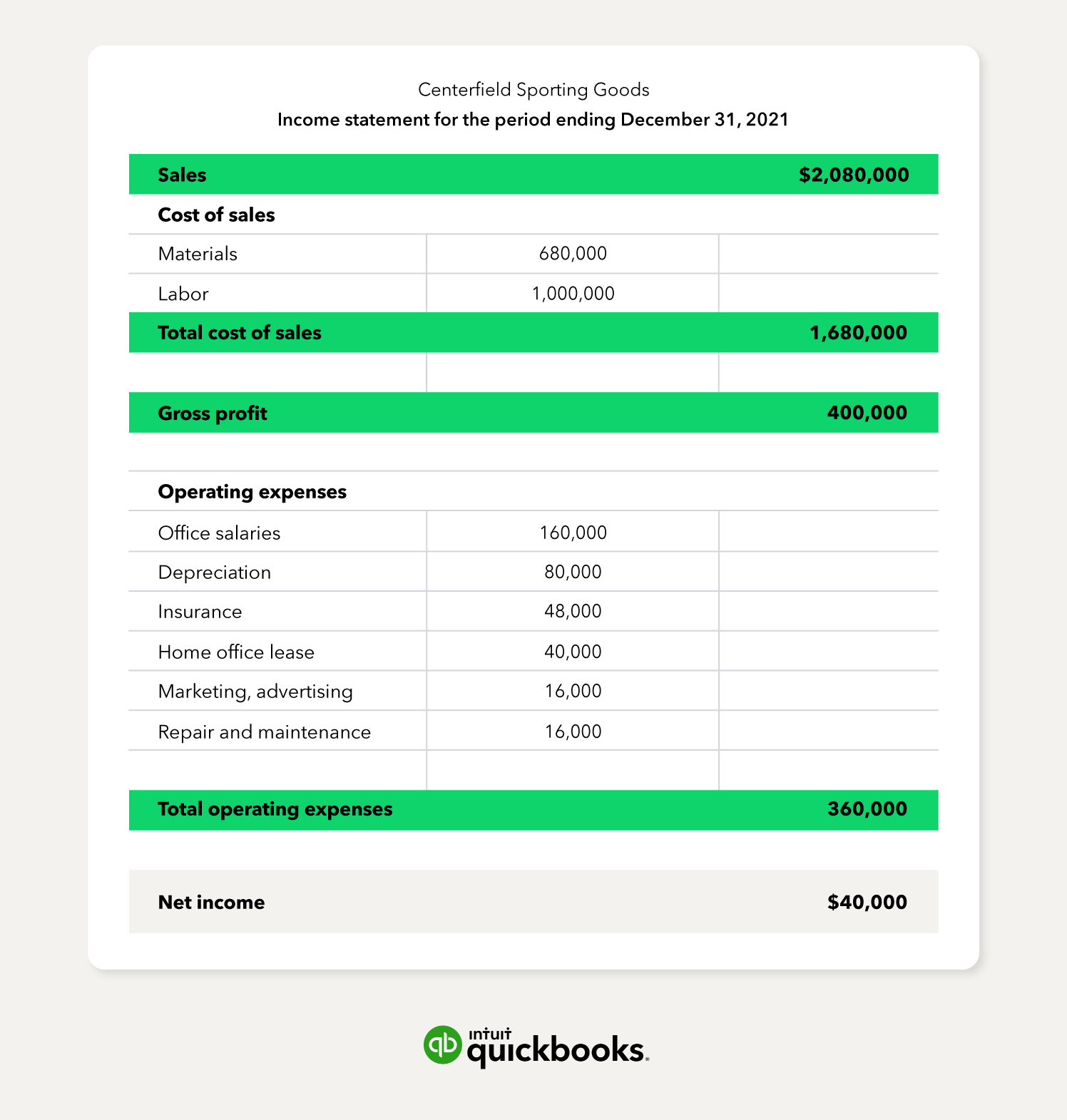

Without cash assets that a company can use to invest its challenging to scale. Therefore OCF 500.

The Monitoring Role Of Institutional Ownership On The Relationship Between Free Cash Flow And Assets Efficiency

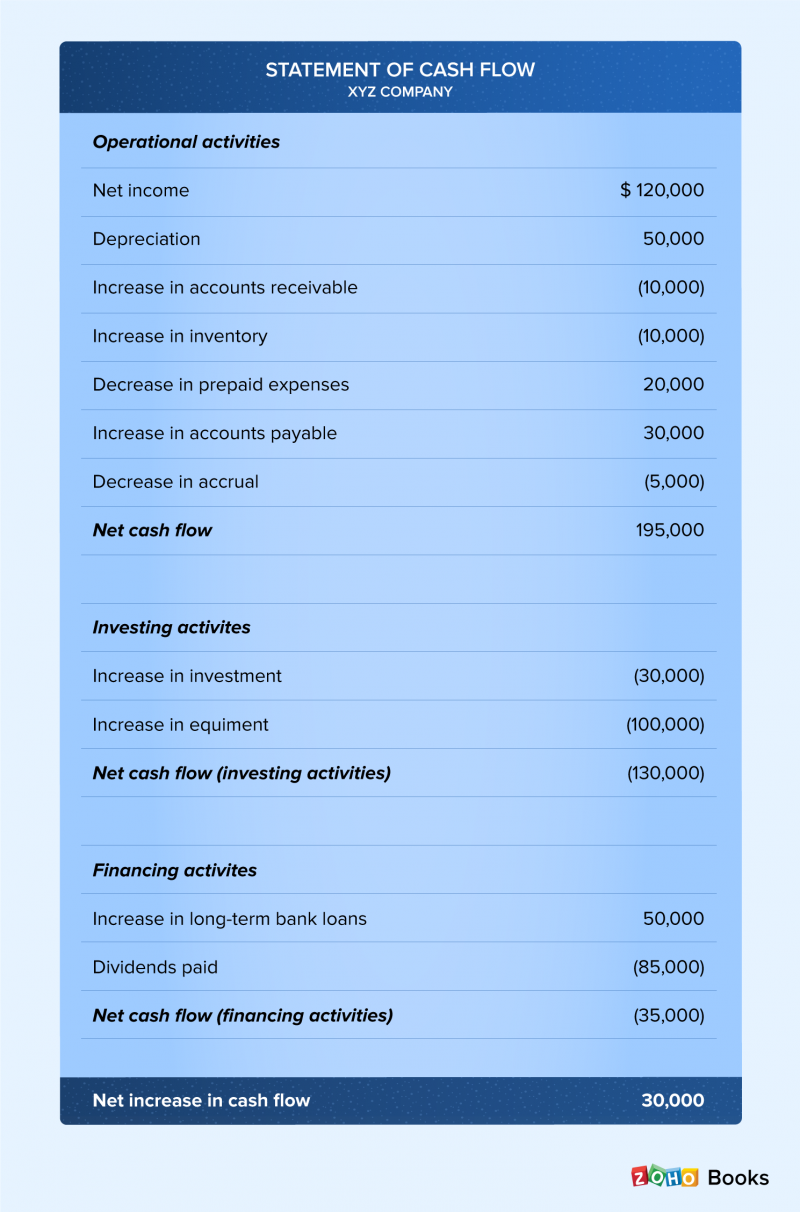

In accounting cash flow is a measure of changes in a companys cash account specifically its cash income minus the cash payments it makes.

. CFFA 20000 -8000 -2000 10000. What is the Free Cash Flow FCF Formula. The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating activities in a period and is displayed on the Cash.

The cash flow is the net between cash inflow and cash outflow. Funds from Operations 100000 200000. It is the net amount of cash and cash.

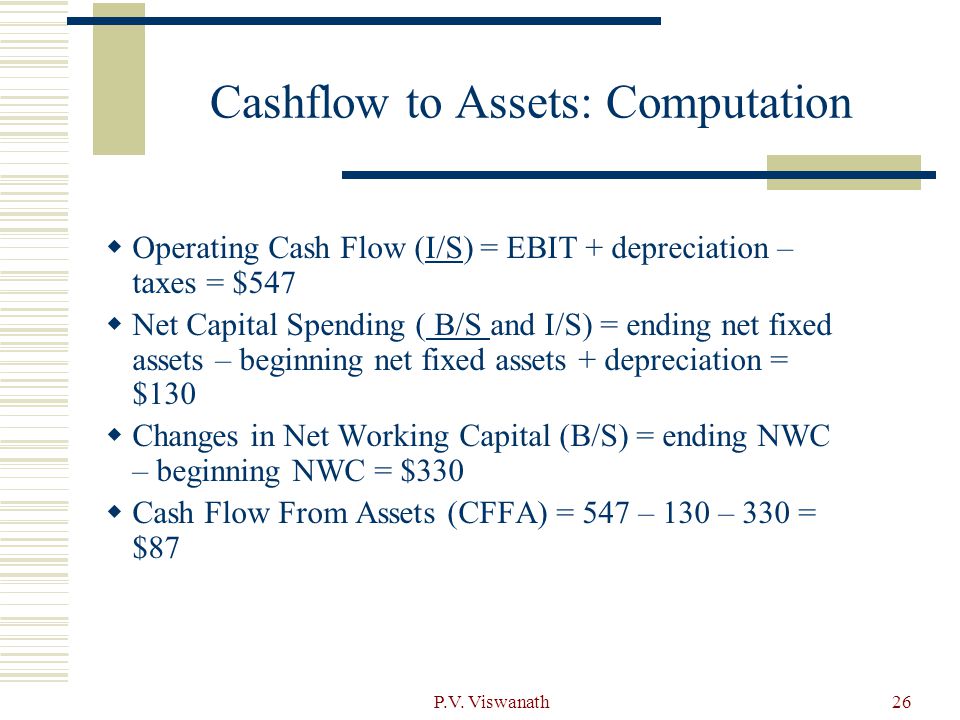

Operating Cash Flow Net Income Changes in Assets Liabilities Non-cash Expenses Increase in Working Capital. Cash Flow From Assets Formula. The following equation can be used to calculate the cash flow from the assets of a business.

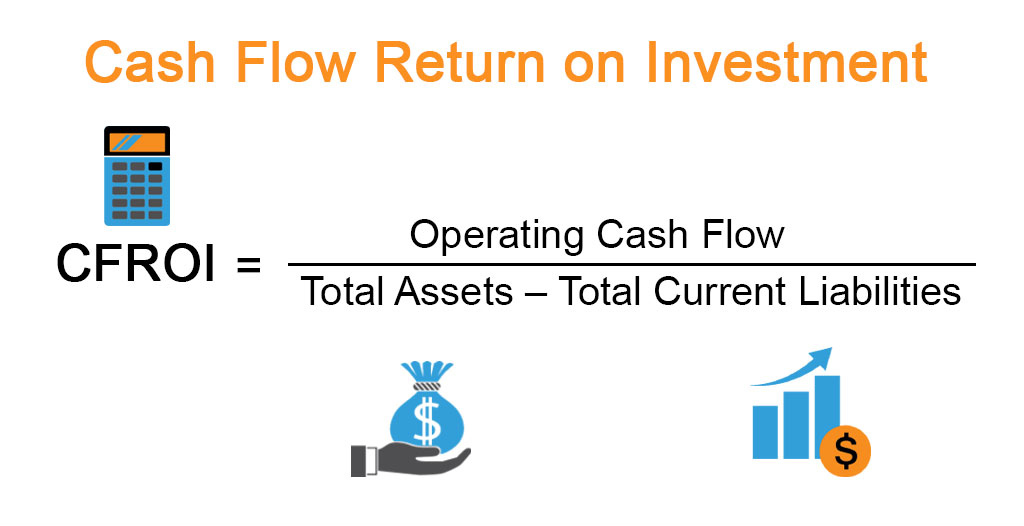

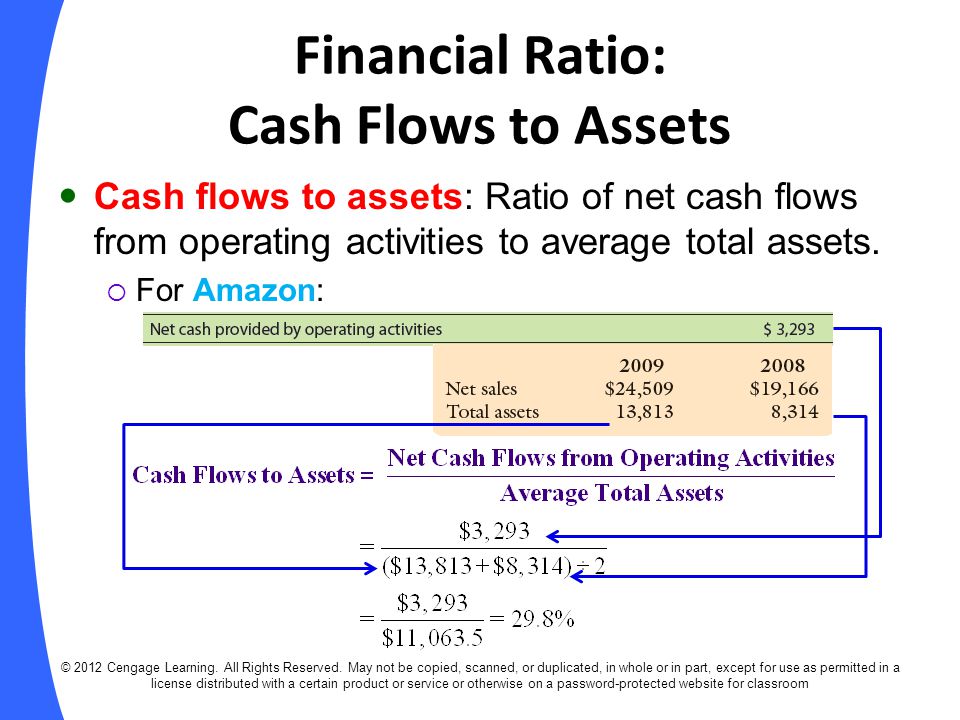

Cash returns on assets cash flow from operations Total assets. Cash flows in this category are often used for product development asset procurement and. Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow.

Johnson Paper Company is a family company that. CA F CE WC. Funds from Operations Net Income Depreciation Depletion Amortization Deferred Taxes Investment Tax Credit Other Funds.

Operating cash flow capital spending and change in. Here are some examples of how to calculate cash flow from assets. Cash flow from assets is the total cash flow to creditors and cash flow to stockholders consisting of the following.

Example of calculating cash flow from assets. Suppose a company has a net income of 756 a non-cash expense of 200 and changes in asset-liability ie inventory is 150 account receivable. Cash flow to total assets ratio measures the ability of the company to use its own assets to generate cash flow.

Cash flow from assets formula cash flow from operation net working capital change in fixed assets. Lets consider the example of an automaker with the following financials. Operating Cash Flow 55256 million 624 million 12547.

Example of Cash Returns on Asset Ratio. This calculation of cash. Where CA is the cash flow.

The generic Free Cash Flow FCF Formula is equal to Cash from Operations minus Capital ExpendituresFCF represents the. N Net capitalspending. W Changes in net working capital.

Cash Flow Return On Investment Examples With Excel Template

Cash Flow Adequacy Ratio Formula And Calculator Step By Step

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

How To Calculate Cash Flow For Your Business Direct Vs Indirect Cash Flow Zoho Books

How To Prepare A Cash Flow Statement Model That Balances Toptal

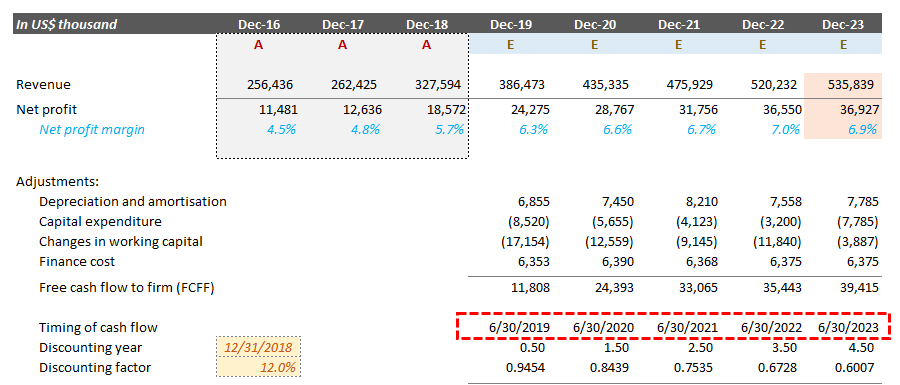

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Chapter 12 The Statement Of Cash Flows Ppt Download

How To Calculate Total Assets Definition Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cash Flow To Assets Desjardins Online Brokerage

Cash Flow Line By Line Long Term Assets Youtube

Cash Flow To Assets Desjardins Online Brokerage

Understanding Cash Flow Analysis Ag Decision Maker

Accounting And Finance Ppt Video Online Download

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Cash Flow Statement Explanation And Example Bench Accounting